The cycle of cheap energy, a strong dollar, and weak global demand (including a weak China), first described in “Crude Analysis of Crude: I Enter the Center of the Cycle”, might give way to what could be a significant event.

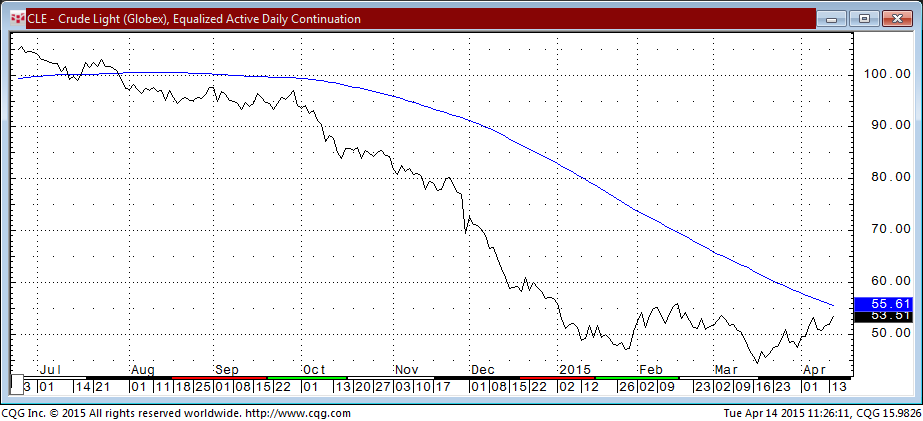

The price of the Crude Light Oil contract, traded on Globex, is nearing its 100 day moving average price for the first time since the end of July 2014.

This technical lends to a better understanding of where we are in the cycle. Take it to mean at least that the velocity of the sell-off has abated, and we might be building some real support around this level.

The Next Interesting Question That Begs Asking

If the price of crude remains stable, will we see the Euro currency price stabilize? Take a look at the chart of the Euro Fx contract on the CME Group’s Globex platform. Below, you can see its price behavior against its 100 day moving average. The next couple weeks will be telling concerning where these two contracts trade relative to their 100 day moving averages.

[…] at yesterday’s article, “A New Event Within the Cycle of Lower Crude…”. The article begs the question that is extremely difficult to ask: What happens when or if crude […]