Chicago’s pension system (for police and firefighters) is all-but-officially bankrupt, and Chicago’s property owners look like the most likely target for the city’s desperate attempts to save it.

According to a report by Nuveen Investments, a state law passed in 2010 — but that kicks in next year — requires Chicago to massively increase its pension payments in 2016. And I do mean MASSIVELY: “Based on state law and recent actuarial valuations, Chicago is required to contribute $839 million to its policemen’s and firemen’s pensions in 2016 … But the city has only budgeted for a pension levy of $290.4 million.”

This means that the city has to pay an additional $540 million. In ONE year.

Where will they get that much money? They only have a couple legitimate options, none of them good. The best one being bandied about is to increase property taxes … by almost 50%.

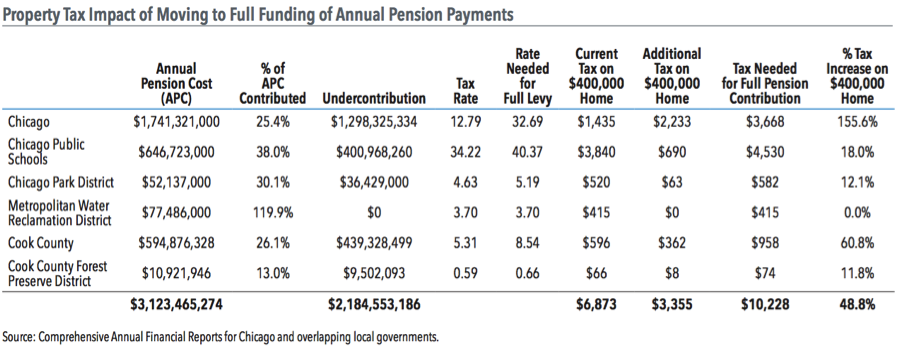

Nuveen Investments breaks down these staggering numbers:

To get a sense of the magnitude of the property tax increases necessary to move to full funding of annual pension payments, Nuveen Asset Management analyzed the 2013 property tax levies, pension payments and Annual Pension Costs (APC) for Chicago and its overlapping taxing districts as reported in their respective audited financial statements. We analyzed the tax bill of a theoretical $400,000 home in Chicago under current tax requirements and a scenario under which the city and its overlapping taxing districts all make full annual pension payments. … All tax figures are from each entity’s 2013 fiscal year – the most recent fiscal year in common for all issuers.

Based on our review of each government’s fiscal 2013 audited financial statements, the owner of a $400,000 home would have paid approximately $6,873 in property taxes. … Altogether, the owner of a $400,000 home in Chicago would need to pay $3,355 in additional property taxes to support full annual pension contributions – increasing the tax bill to $10,228 for a single year jump of nearly 49%.

Increasing property taxes by 5% causes loud grumbling and significant hardship. Increasing them by 10% leads to people with the means to do so to leave the city in droves as soon as they can. Increasing them by 50%? I can’t imagine it. Anyone who could get out of Chicago quickly would, raising the very real possibility that it could become the next Detroit.

If there’s any way for Mayor Rahm Emmanuel to secure a third term after doing this, I don’t see it. My guess is that he doesn’t right now, either. He also likely realizes that he can’t avoid making this decision. This week, Moody’s officially lowered Chicago’s bond rating to junk status after the state supreme court unanimously ruled that its proposed pension reform plans were unconstitutional. Mayor Daley mortgaged the city’s future (by spending significantly on public works projects and giving lavish pay and pension increases to municipal unions) and Rahm got stuck with the bill. There are no good or easy options left for Chicago to get out of this mess.

There is a lesson for the rest of America in Chicago’s tragic situation: a trend that cannot continue indefinitely will eventually end.

Today, America’s pension system — Social Security and Medicare — is at least as underfunded as Chicago’s is. A conservative reckoning of the gap in what we’ve promised retirees and elderly citizens and what we can currently pay for is $49 trillion (with a “t”). That works out to about $150,000 in extra money owed by every person in the country. That trend, by any measure, is unsustainable.

Currently, we are inured to these numbers by the seductive voices assuring us that America’s sovereign debt doesn’t matter because the world will keep buying dollars. There is no “better option” for our lenders to shift their funds to. The Euro is on a seemingly inexorable decline. The Yen isn’t independent enough. The Yuan isn’t ready (and may never be, depending on your view of China’s long-term future). That’s it for viable options, so America can rest secure. As the saying goes, “If you owe the bank a half a million dollars and you can’t pay, you have a problem. If you owe the bank a half a billion dollars and you can’t pay, the bank has a problem.” Our debt will never be called due, because our lenders can’t afford to call it due.

In the near term (the next 5-10 years), that analysis is probably accurate. But there’s no immutable law declaring that the USA cannot default. Our debt trend is unsustainable. At some point, it will end. And at that point, we will be even less prepared to deal with the consequences of our irresponsible financial policies as Chicago is today.

As the Iron Lady said, “At some point, you run out of other people’s money.” That moment is rapidly approaching for Chicago. It continues to draw nearer for America, as well.